Introduction:

In the ever-changing capital market, companies sometimes undergo what is termed as significant corporate action which could be a reason for excitement or concern on the part of the shareholders and investors. An example of the events is a reverse stock split which is a well-planned financial tactic to respond to the specific issues that the company has. It is needed that investors thoroughly comprehend the complex modality of the reverse stock split in order to make the scripted decision. In this piece, we are primarily going to define what is reverse stock split, what its impact(s) will be and we will even introduce a useful calculator dubbed Reverse Split Calculator to help investors in dealing with the reverse stock split successfully.

Table of Contents

What is a Reverse Stock Split?

A reverse stock split, or reverse share split comprehensively, is a corporate action that happens as a company decreases the number of its issued shares and increases the price per share by corollary. In contrast to an ordinary stock divide, which multiplies the number of shares as well as reduces the price per share, possesses remarkably the opposite effect, allowing you to restore the per-share value. Frequently, this operation is signified by the ratio of 1-for-2, 1-for-5etc. The currency involved is sharing among consolidated ones.

Implications of Reverse Stock Splits:

Reverse stock splits can have various implications for shareholders and the company itself:

- Compliance with Exchange Requirements: The companies can sometimes take disparate preferences of reverse splits to meet listing regulations set by exchanges, such as the lowest share price levels.

- Perceived Value Enhancement: Reverse splits increase the shareholding value and thereby lead to an illusion of goodwill, and may be envisaged by new people, who try to invest in a company.

- Market Signal: A reverse split could suggest financial challenges or the need for business reshaping, which is likely to influence investors’ perceptions.

Understanding the AMC Reverse Split:

The recent news about AMC Entertainment Holdings, Inc., the popular movie theater chain, has been linked to talks of their possible carryout shares. During those times, AMC underwent extreme declines in the value of its shares caused by online stock market speculation which also involved an increase in the number of short positions the company held. In order to normalize the movement of its share value, AMC took steps to maneuver the market conditions. Reverse split caption themselves as an invaluable tool for any investor wanting to grasp the reverse split’s impact in their AMC portfolio. By employing an AMC Reverse Split Calculator, you can gain crucial insights.

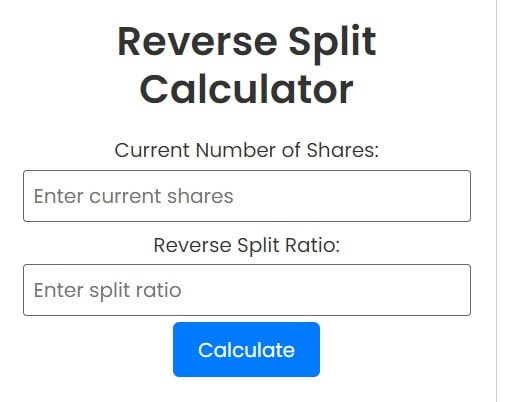

Introducing the Reverse Split Calculator:

The reverse split calculator is designed to save investors from the unnecessary hardships of calculating the outcome of a reverse split on their listed shares by hand. Whether it’s a generic stock reverse split calculator or a specialized option reverse split calculator, these tools offer several key functionalities:

- Adjusting Share Quantities: Input the number of shareholdings currently and the reverse split figure to know what will be the amended number of shares following the split.

- Estimating Share Price Impact: Estimate the share price you end up having after the completion of the split using the following formula: Post-split Price = Current Share Price ÷ RSV++

- Assessing Investment Value: Discover how a subsequent split might take a toll on the total worth of your portfolio.

Using the Reverse Split Calculator:

Let’s illustrate the functionality of the Reverse Split Calculator with an example:

Scenario: Company XYZ announces a 1-for-5 reverse split, and you currently hold 500 shares priced at $10 each.

Step 1: Input the current number of shares: 500 Step

2: Enter the reverse split ratio: 1-for-5

Step 3: Input the current share price: $10

Upon calculation, the Reverse Split Calculator reveals that post-split, you will hold 100 shares priced at $50 each.

Formula:

Understanding the mechanics behind a reverse stock split is essential for investors to grasp its implications accurately. The formula to calculate the effects of a reverse split on shares and share price involves straightforward calculations. Here’s the formula broken down:

- Adjusted Shares = Current Shares / Reverse Split Ratio This calculation determines the number of shares an investor will hold after the reverse split. It involves dividing the current number of shares by the reverse split ratio, which represents how many old shares will be consolidated into one new share.

- Adjusted Share Price = Current Share Price * Reverse Split Ratio This calculation estimates the post-split share price by multiplying the current share price by the reverse split ratio. The result indicates the expected share price after the reverse split, reflecting the consolidation of shares into fewer units.

By applying these formulas, investors can gain insights into the potential impact of a reverse stock split on their holdings and make informed decisions about their investment strategies. Utilizing a Reverse Split Calculator streamlines this process, allowing investors to perform these calculations quickly and accurately, enhancing their ability to navigate the complexities of the stock market.

Investor Perception and Liquidity:

The stock market can adversely affect investor impression and stock liquidity when a stock split happens in the reverse direction. Even though a target high share price may be attractive to some investors, they may also get the wrong impression and consider it as a symbol of financial difficulties. To add to the issue, lowering the number of shares in the market by the split may have impact on the market liquidity, which makes prices change and therefore volatility increase.

Options Market Dynamics:

Through the change of stock split also we can face the significant things in perspective of options traders. As in reverse stock splits, the options contracts are subject to modifications such as contract multipliers amendment, strike price revision, and the number of options per contract correction. An ETF Reverse Split Calculator is very important when performing a post-split analysis. This tools helps us to understand its impact on the options positions structure and to adjust our options trading strategies accordingly.

Conclusion:

Reverse stock splits is a more confusing corporate financial action that can highly affect investor’s financial situations. Through this useful tool, the split reverse calculator, investors will be able to grasp the full scope of these operations and take the logical step of the decision. Whether it’s the rule of effect of a general stock reverse split or forecasting consequences of AMC reverse split they will present meaningful information using their calculators which will help trading in the dynamic market environment. Get more knowledgeable, become more confident, and do not ignore your investor mentality.

Incorporating keywords: reverse split calculator, options reverse split calculator, stock reverse split calculator, AMC reverse split calculator.

FAQs

How do you calculate a reverse stock split?

To calculate a reverse stock split, you need to know two key pieces of information: the current number of shares outstanding and the reverse split ratio. The reverse split ratio represents how many old shares will be consolidated into one new share. The formula to calculate the adjusted number of shares post-split is: Adjusted Shares = Current Shares / Reverse Split Ratio Additionally, to estimate the adjusted share price after the reverse split, you can use the formula: Adjusted Share Price = Current Share Price * Reverse Split Ratio

What is a 1 to 100 reverse stock split?

A 1-to-100 reverse stock split means that for every 100 shares an investor holds, they will receive 1 share after the reverse split. This consolidation reduces the total number of outstanding shares and increases the share price proportionally.

What is a 1 for 45 reverse split?

A 1-for-45 reverse split signifies that for every 45 shares an investor holds, they will receive 1 share after the reverse split. This action consolidates the shares, resulting in fewer outstanding shares and a higher per-share price.

What is a 1 for 30 reverse split?

A 1-for-30 reverse split indicates that for every 30 shares an investor holds, they will receive 1 share after the reverse split. This consolidation reduces the total number of shares outstanding while increasing the share price accordingly.

What is a 1 to 10 reverse split?

A 1-to-10 reverse stock split means that for every 10 shares an investor holds, they will receive 1 share after the reverse split. This consolidation of shares results in a decrease in the total number of outstanding shares and a corresponding increase in the share price.

What is a 1 for 7 reverse stock split?

A 1-for-7 reverse stock split implies that for every 7 shares an investor holds, they will receive 1 share after the reverse split. This consolidation reduces the total number of outstanding shares and typically leads to an increase in the share price.