In the maze of finance and investing, where uncertainty looms large, one concept stands as a guiding light for savvy investors: capitalization of inflation premium calculator. Today, in the world of an inflation spree that can bite the heels of everyone at any moment, finding the inflation premium as the way to success and overcoming weakness is like an art to perform.

Table of Contents

So, what exactly is this inflation premium, and why does it matter?

The premium for inflation is a mark-up of investors’ return necessary to counter the anticipated degradation of purchasing power under inflation. Similarly, in layman’s terms, it’s about the return that investors pay to get a rate that is above the inflation so that they can be sure their money will grow faster than the price of the markets as it rises over time. Thus, this hypothesis turns out to be critical in interpreting the real worth of assets in the long run.

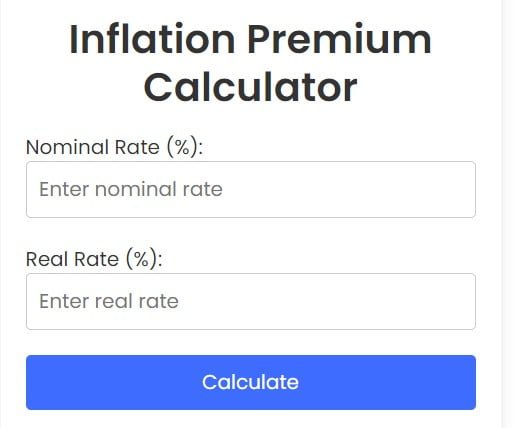

How to Use the Inflation Premium Calculator:

- Input the nominal interest rate and real rate commings with the present and predictable future inflation into the inflation premium calculator.

- My calculator will compute the inflation rate premium and give you your investment’s real return.

- Keep this record in mind during the process of evaluating the potential returns on numerous investment opportunities and choose your portfolio wisely.

But how does one calculate this elusive inflation premium?

Enter the hero of our financial saga: an inflation premium calculator that people can apply. This useful tool gives a complete outlook based on several things including current inflation, anticipated future inflation, and the risks associated with the investment to lead investors to a clear, accurate expectation of the actual return on their investments.

Let’s delve into this concept further using a hypothetical scenario:

For example, suppose you are planning on purchasing an investment bond that has a fixed interest rate equal to 6% annually. Sounds profitable, right? But hold your horses! The prevalent rate of inflation is around three percent. Subtracting an inflation premium from that 4%, you would be left with a “real” return of 3%.

Yet, as long as you know how to use the inflation premium calculator to add the inflation rate to the nominal interest rate for the calculation of the actual income, it does not really matter. That would mean an inflation premium of 3% and a real interest rate of 3%. However, please tell me, lost in the hype the inflationary effect of 6% didn’t appear rather impressive, did it?

But the inflation premium calculator has another spell. It allows investors to make more precise choices about their investment roadmap, with the help of determining the real value of the future investments in relation to their current cash flows.

What’s more, this advisor acts as a compass for the investor lost in the turbulent seas of the financial markets, thus it helps them to navigate like a pro even in difficult situations. Whether you are a veteran investor or beginning your journey into the field of finance, it seems that the only constant thing in this world, besides the death of every person, is inflation. However, that does not stand for the rates of investment return as a result of inflation. Thus, understanding the inflation dynamics and the implications of the same for returns of investment is something one should not disregard.

conclusion

The inflation premium calculator is another financial gadget, no doubt. But it is more than that. It is the signal of clarity in the foggy and obscene world, heralding the investors to the shores of safety and sound. Hence, in case you have a doubt concerning a potential financial investment, don’t avoid the obvious – you will have to consult your inflation premium calculator – the key to financial understanding.

FAQs

How do you calculate inflation premium?

To calculate the inflation premium, you typically subtract the expected inflation rate from the nominal interest rate or investment return. This provides the additional return needed to maintain the purchasing power of an investment in real terms.

What is inflation premium in finance?

In finance, the inflation premium is the extra return that investors demand to compensate for the anticipated loss in purchasing power due to inflation. It represents the premium added to the nominal interest rate or investment return to ensure that the real return remains positive.

What are examples of inflation premiums?

Examples of inflation premiums include the additional interest paid on inflation-protected bonds (TIPS) above the inflation rate, the higher yields demanded by investors on long-term bonds compared to short-term bonds to hedge against inflation risk, and the higher returns required on stocks or real estate investments to offset the effects of inflation.

How do you measure inflation risk premium?

The inflation risk premium can be measured by comparing the yield on inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), with the yield on comparable nominal securities. The difference between the two yields represents the market’s assessment of the inflation risk premium

How is inflation calculated?

Inflation is commonly calculated using a price index, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). These indices track the changes in the prices of a basket of goods and services over time. The inflation rate is then determined by comparing the current index value to a base period index value and expressing the difference as a percentage.

How do you calculate a premium on a price?

To calculate the premium on a price, you subtract the original price from the premium price and then divide the result by the original price. Finally, multiply the quotient by 100 to express the premium as a percentage of the original price. The formula is:

Premium percentage={(Premium price−Original price)/Original price}×100

Similar Tools

Return on Net Worth calculator