Introduction:

Financial analysis is incomplete without understanding important metrics which can further help in making valid judgments. One quantitative metric, which is all too often taken for granted but highly instructive, is the equality of return on assets – bits of which are termed, the Return on Networth formula. This calculation namely reflects the contribution of all factors that influence the profits of a firm given their equity capital. In this blog, we unravel the Return on Networth formula (RONW). Furthermore, we explain its importance for investors and business analysts and present a great tool the Return on Net Worth Calculator which enables everyone to use the formula easily.

Table of Contents

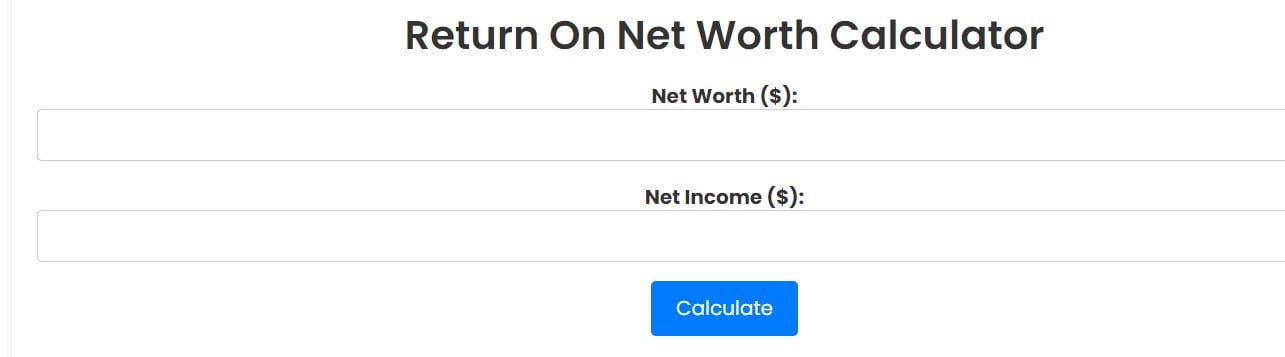

How to use the Return on Net Worth calculator:

Because of this, investors and analysts are able to take full advantage of RONW and they can use the simplistic Return on Net Worth calculator we’ve provided. Here’s how to use it:

- Access the Calculator: Go to the website, find the page devoted to calculating the Return on net worth, and read carefully through all the questions and instructions.

- Input Financial Data: On the required financial data, please input your net and net worth figures in the designated fields.

- Calculate RONW: Hit the “Calculate” button and you get instant RNOW results.

- Analyze and Interpret: Do a study of the RONW percentage calculations that will be able to bring to light the way the company is doing in terms of profitability with regard to the company’s equity.

Introducing the Return on Net Worth Calculator:

We’ve created an easy-to-use RONW Return on Networth formula calculator tool that we think is an essential tool for investors and analysts to harness the potential of. The intuitive nature of this calculator simplifies the operations which concisely allows a user to feed in related financial data to receive quick calculations on balance return on the net worth. Whether you are a veteran investor looking for a refresher, or an emerging analyst wanting to learn more about our tool, our profitability calculator simplifies complicated financial analysis and helps to make your decision-making process crystal clear.

What is the Return on Net Worth Formula?

Ultimately, the Return on Networth formula acts as a preeminent measure to make a stand on whether a company is producing profit from its investments in a fair amount of capital. It can be interpreted as a rate at which a company generates funds net of any financial input.

RONW=(Net Income/ Net Worth)×100%

Breaking Down the Components:

Net Income: This is the fundamental part of a company’s financial statement displaying the remaining profit after deducing all the expenses, taxes, and interests from the total revenue.

Net Worth: It is referred to as equity in other people and this means the ownership of the remaining assets of the company after deducting liabilities.

Interpreting RONW:

If a higher RONW percentage is achieved, it exceeds the amount of current expenses that a company spends in the form of equity to generate profits. Whereas a RONW could show up lower and it could indicate the inefficiency of the company in the utilization of the capital.

Why RONW Matters:

- Insight into Profitability: RONW allows getting a general profitability measurement in terms of equity invested which can provide the shareholders with crucial intel on the financial health of a company.

- Performance Benchmarking: With the ability to contrast the RONW between different time segments or against a good industry peer, officials can measure how good a certain company’s performance is compared to its considerate rivals.

- Strategic Decision-Making: RONW is a vital facilitator for management with regard to the performance of the newly-planned strategy and the allocation of resources.

Conclusion:

When it comes to the ever-changing finance sphere, what makes one successful enough is the ability to consider the critical metrics. While the Return on Networth formula certainly does function as a beneficial tool pointing the investor or the analyst toward the apparent profitability, this tool is not merely a marker of the profitability but the entire profitability landscape itself. Via our solution RONW and platform including a designed ‘Return on Networth formula’ calculator, you will be able to manage the multi-faceted financial analysis with no effort, opening doors for you to new innovative solutions and skills.

Get access to RONW right now and unlock your future in financial exploration! You will never look back!

FAQs

How do you calculate the return on net worth ratio?

The return on net worth (RONW) ratio is calculated by dividing the net income by the net worth of a company and then multiplying the result by 100 to express it as a percentage. The formula is:

RONW=(Net Income/ Net Worth)×100%

How is net worth calculated?

Net worth, also known as equity, is calculated by subtracting a company’s total liabilities from its total assets. It represents the residual interest in the company’s assets after deducting all debts. Mathematically, it is expressed as:

Net Worth=Total Assets−Total Liabilities

What is the return on net worth percentage?

The return on net worth percentage, often abbreviated as RONW, indicates the profitability of a company relative to its equity. It represents the percentage of net income generated for each unit of net worth. A higher RONW percentage signifies that the company is generating more profits per unit of equity.

How do you calculate ROE?

Return on Equity (ROE) is calculated by dividing the net income by the average shareholders’ equity. The formula is:

ROE=(Net Income/Average Shareholders′ Equity)

What is a return on investment or net worth?

Return on investment (ROI) or return on net worth refers to the profitability metric that assesses the return generated from investments relative to the company’s net worth or equity. It helps investors evaluate the efficiency of their investments in generating profits.

Why is net worth calculated?

Net worth is calculated to determine the financial position of an individual or a company. It provides insights into the assets and liabilities owned by an entity and serves as a measure of its overall financial health. Calculating net worth helps in assessing solvency, making investment decisions, and planning for future financial goals.