Consumerism in today’s world is getting more and more peculiar. Clever shoppers are seeking special offers to get for themselves the highest value from buying. People lean on another widely used scheme called cashback reward programs to some extent as well. Cashback credit cards and programs of reward are becoming more and more popular these days. Learning to calculate cashback fast and accurately is thus key, now, more than ever. In this extensive guide, we`ll investigate the cash back calculation ins and outs, that will definitely benefit your smart decision-making and bring you more savings opportunities.

Table of Contents

Understanding Cash Back Basics

Having better understood the cashback process, let us walk through the nuts and bolts of cash back calculation now. Cash back calculaation works on the principle of incentive where the investors and the retailers give incentives to cardholders in the form of the percentage spent on the purchase as cash rewards. These savings can accumulate to a large sum in the long run thus becoming a backup plan to cover unforeseen expenses or to allow yourself to take a step in saving your money for bigger dreams.

Factors Influencing Cash Back Calculation

The reasons cash back rewards depend on are quite distinctive. Understanding these factors is crucial for accurately estimating your potential earnings:

- Cash Back Rate: The cash back ratio is the portion of your payment that will be given back as an incentive. The credit card companies and reward programs often differ in their rates of cash back rewards or offer better rates on specific spending categories, among which are groceries, gas, dining, or travel expenses.

- Spending Habits: Not only your spending habits but also your purchasing style and the frequency of the purchases play an important role in earning cash back. Examining your monthly expenses subdivided into all categories will help you find where to pay the most thanks to the right credit card, purchasing using the most suitable card for each spending category.

- Bonus Offers and Promotions: Edit yourself accordingly and do not forget to monitor any kind of bonus offers provided by credit card companies. This drawback can turn into a great advantage if the company runs occasional promotions, and the temporary incentives will skyrocket your cash back earnings.

- Redemption Options: If you really understand the redemption options, you will be in a position to always redeem your cash back rewards. Some cards indeed provide pliable redemption options enabling you to redeem cash back as statement credits, deposits, gift cards, and other merchandise. The “crunching the numbers” exercise helps you know the rewards from each redemption method therefore do the most rewarding one.

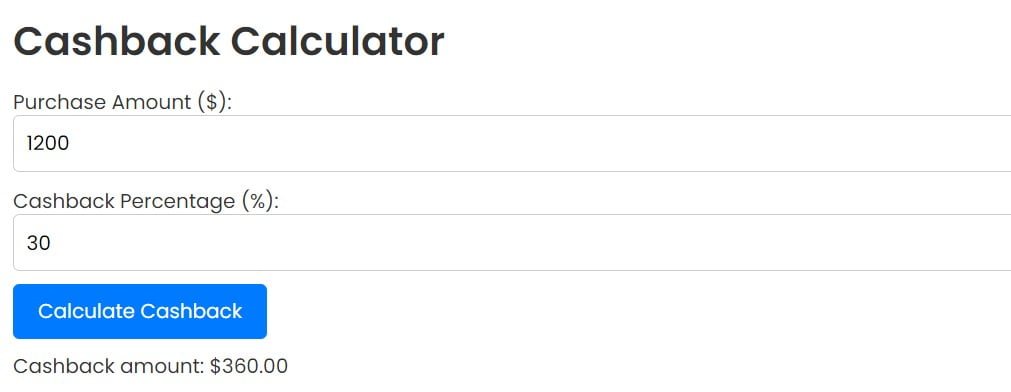

Utilizing Cash Back Calculators

Cash back calculation is not just a useful facilitator, they are the perfect tool for coming up with the projected earnings quickly and making comparative analyses between different cards and reward offers. This means that you only have to enter your spending amounts per month in different areas with the information on the cash back rates of various cards; you will be able to get the cash back return that is tailored to your spending habits. It makes you capable of making wise choices, specifically, choosing the credit card that fits your spending patterns perfectly.

The Cash Back Calculation Scheme in detail.

Now, let’s walk through a step-by-step process for cash back calculation rewards:

- Gather Your Spending Data: To get started, collect all the monthly records of your expenditures across the major categories that include groceries, gas, dining, entertainment, or any other important parts of your budget.

- Identify Cash Back Rates: Double check your interest and rebate rates for various spending categories of your credit cards or your rewards program. These kinds of bonuses of extra categories of 2% or promotional rates may be present in some credit cards.

- Calculate Cash Back Earnings: In order to calculate the cash back earnings for the application category, take the category spending and multiply this by the corresponding cash back rate.

- Summarize Total Cash Back: Sum up the cash back earnings you have received from the categories of expenses to get your overall cash back reward of the month.

- Evaluate Redemption Options: See whether you can redeem your cash back for gift cards or redeem spare money for further towards your investment or particular purpose whichever is suitable to your wants and preferences.

Example: Calculating Cash Back Rewards

To better illustrate the process of cash back calculation, let’s consider an example:

Suppose you have a cash back credit card with the following cash back rates:

- Groceries: 3%

- Gas: 2%

- Dining: 1%

- All other purchases: 1%

And let’s say your monthly spending is as follows:

- Groceries: $500

- Gas: $200

- Dining: $100

- All other purchases: $700

Now, let’s calculate your cash back earnings for each spending category:

- Groceries: Cash back = $500 * 3% = $15

- Gas: Cash back = $200 * 2% = $4

- Dining: Cash back = $100 * 1% = $1

- All other purchases: Cash back = $700 * 1% = $7

Total cash back earnings for the month = $15 + $4 + $1 + $7 = $27

Formula for Cash Back Calculation

The formula for calculating cash back rewards is straightforward:

Cash back = Spending amount * Cash back rate

Where:

- Spending amount represents your expenditure in a specific spending category.

- Cash back rate indicates the percentage of cash back offered for that spending category.

By applying this formula to each spending category and summing up the results, you can determine your total cash back earnings for any given period.

Maximizing Cash Back Rewards

To maximize your cash back rewards, consider the following strategies:

- Strategic Card Usage: Consider shopping with credit cards that offer higher cash back for large shopping expenses in your top spending categories. Take it up for benefits from a high cashback card if the majority of the card bill comes from groceries.

- Stacking Rewards: Acknowledge the benefits of stacking rewards; it is, in the sense, that you combine a cash back credit card and other such promotions, discounts, or loyalty programs. This is an excellent way of increasing the amount of money you can save and promoting rewards efficiency as well.

- Regular Review and Optimization: Regularly assess both your spending habits and the credit card rewards programs to make sure you are getting the most out of your money. Different needs and preferences arise as you get older. In case you are considering a card or program don’t be quick to jump to a different card or program which you deem more suitable to your current lifestyle.

- Avoid Overspending: Getting a cash back reward may lure you into engaging in an unwise spending behavior that’s to only make a few bucks on prices that you’d otherwise skip. It would therefore be wise to focus on what we wanted but is also affordable to us. Adhere to the budget you have and consciously make your expenditure yield maximum savings but do not let it get into debt.

Conclusion

Getting the most out of their cash-back calculation is the number one game changer for smart shoppers or people who seek to save the maximum amount of money possible when making their purchases. That is, if you study the factors affecting points to be earned through cash back and use cash back calculators, then you can get a lot more. Also, this will help you to be more financially rewarding. In a nutshell, get moving, do take-home homework, and set your money walking already.

FAQs

What is 5% cash back on $100?

To calculate 5% cash back on $100, simply multiply $100 by 5% (0.05): Cash back = $100 * 0.05 = $5

How do you calculate 15% cash back?

To calculate 15% cash back, multiply the purchase amount by 15% (0.15): Cash back = Purchase amount * 0.15

What is 1.5% cash back on $100?

To determine 1.5% cash back on $100, multiply $100 by 1.5% (0.015): Cash back = $100 * 0.015 = $1.50

What is 2% cash back on $1000?

Calculate 2% cash back on $1000 by multiplying $1000 by 2% (0.02): Cash back = $1000 * 0.02 = $20

What is 1% cash back on $1000?

To find 1% cash back on $1000, multiply $1000 by 1% (0.01): Cash back = $1000 * 0.01 = $10

What is 1.5% cash back on $1000?

Determine 1.5% cash back on $1000 by multiplying $1000 by 1.5% (0.015): Cash back = $1000 * 0.015 = $15